Contents:

Liquidity refers to the https://trading-market.org/ of ease with which an instrument can be bought or sold at a relatively stable price. In trading, liquidity plays an important role as it determines how easily the price of an asset can change within a specific time. In a liquid market, trades can be executed quickly while in an illiquid market, trades cannot be executed as fast. An investment fund is a capital pool in which individual investors add funds. A fund manager invests the accumulated capital in a portfolio of financial instruments that may include stocks, bonds, and other assets. Technical indicators are mathematical calculations derived from historical data.

Singaporean suspect denied bail – Bangkok Post

Singaporean suspect denied bail.

Posted: Thu, 19 Jan 2023 08:00:00 GMT [source]

Digital 100s trading is a type of trading that involves utilising digital 100 options. Digital 100s are a type of financial derivative, also referred to as binary options. CPI stands for consumer price index, an average of several consumer goods and services that are used to give an indication of inflation.

Average Hourly Earnings

The information in this site does not contain investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Variable cost is a business expense which is subject to change when sales volumes change. This could mean that variable costs either increase or decrease depending on a company’s current output. Unborrowable stock is the stock that no one is willing to lend out to short sellers. When shares in a company become unborrowable, the traditional means of short selling them is impossible.

FTX Downfall Fails To Rub On Bitcoin (BTC), But Not Avalanche (AVAX) Bitcoinist.com – Bitcoinist

FTX Downfall Fails To Rub On Bitcoin (BTC), But Not Avalanche (AVAX) Bitcoinist.com.

Posted: Thu, 01 Dec 2022 08:37:53 GMT [source]

A https://forexarena.net/ consisting of financial institutions and dealers in money or credit who wish to either borrow or lend. In international banking, the limit a bank is willing to lend in a country. A price that has advanced or declined the permissible limit permitted during one trading session. The period between the beginning of trading in a particular future and the expiration of trading.

Leverage

Once a breakout from the channel takes place, the https://forexaggregator.com/ is expected to move a distance equal to the width of the channel. It forms at the top of an uptrend or near a resistance area. The candle has a long white body and very small or non-existent upper shadow, that is, Shaven Top. It reveals the determination of the bears to push prices lower. The candle has a long white body and very small or non-existent lower shadow, that is, Shaven Bottom. It reveals the determination of the bulls to push prices higher.

- A safety feature for the EMS which creates an emergency exit for currencies which become the singular focus of various adverse forces.

- The closer the result is to 100, the stronger and more significant the trend is.

- Traders enter the market with long positions but eventually the sellers’ pressure overcomes buyers’ pressure and the candlestick closes at the lower area of the inverted hammer.

- The law of supply and demand shows how the relation betweeen price, supply and demand works.

- The daily adjustment of an account to reflect unrealised profit and loss.

- For instance, in the candlestick analysis, the hammer, inverted hammer, shooting star and test bar are the few examples of a reversal pattern.

All options of the same class which share a common strike price and expiration date. Options on the same underlying futures being contract which expire in more than one month. An overnight swap, specifically the next business day against the following business day (also called Tomorrow Next, abbreviated to Tom-Next). Reversal patterns that occur at the end of the trend, signalling the trend change. A price recognised by technical analysts as a price which is likely to result in a rebound but if broken through is likely to result in a significant price movement. A currency that is normally quoted as dollars per unit of currency rather than the normal quote method of units of currency per dollar.

Current Account

In the course of a decline, a long white candle gaps above the previous black Marubozu and rallies higher, closing at the high of the session, demonstrating strong bullish power. Gann considered the 45 degrees line the most important line, where the market has some form of balance. Prices above the 45 degrees line indicate an uptrend, where below – a downtrend. During an uptrend, prices will find resistance at the lines above the 45 degrees line. Consequently, prices are expected to find support at the lines below the 45 degrees line.

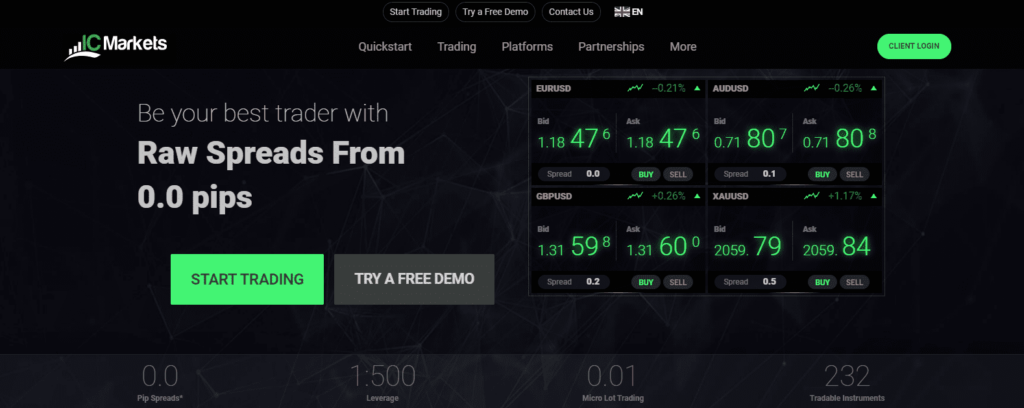

When a CFD provider offers lower spreads than its competitors, this means traders can enjoy a smaller difference between the Buy and Sell price of the underlying FX trading pair. 64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The spread represents the difference between the ask and bid price of any currency pair. In most instances, this figure represents brokerage service costs and replaces transactions fees, with it usually presented in pips.

Commodity Block Currency

Furthermore, take the difference between the Highest High of the last n periods and the Lowest Low of the last n periods – this is the divisor. Parabolic Stop and Reverse is a technical indicator developed by Welles Wilder. It is based on the premise that a strong trend will continue to increase in strength and hence it will follow a parabolic arc. During an uptrend a SAR point starts far from the price and as the price accelerates upwards the SAR points close the gap. When the SAR point reaches the price the long position is closed and a short is opened. It is a system that is always in the market either as long or short.

After a pause in the market that takes the form of a flag or a pennant, a breakout occurs out of the pattern in the same direction as the pole. The measuring implication is equal to the length of the pole, hence half-mast. To sell a financial instrument with the expectation that it will decline in price. Managers are asked to state whether business conditions have improved, remained the same or deteriorated, compared to the precious month. It’s a technical analysis oscillator developed by Bill Williams.

Rollover definition

MFI below 20 suggests asset has been oversold, while MFI over 80 suggests asset has been overbought. Spikes are the hardest market turns to deal with because the spike happens very quickly with little or no transition period. Using recent gains and losses to compute if a security is overbought or oversold. Generate trading signals when divergence between price and RSI, or when RSI is above 70 or below 30 (might consider using or FX). The cost, usually quoted in terms of dollars or pips per day, of holding an open position.

- Usable Margin – refers to funds that may be used open new positions or removed from the account.

- Traders use Fibonacci extensions to determine profit targets or how far the next price wave could go after the end of a pullback.

- It consists of three bottoms and their corresponding tops.

- The simultaneous purchase and sale of the same amount of a given currency for two different dates, against the sale and purchase of another.

- These are the trading history, pending orders history, account history, session history and account statement.

This may be a result of an asset that is highly valued but hard to sell in a swift manner due to the price , a lack of potential buyers, or any other reason. Illiquid options are usually those whose expiration dates are distant. The second currency quoted in a currency pair, it is the currency for which one unit of base currency can be traded, and equal to the pair’s value.

Cable – Cable is a slang term used by forex traders, particularly to refer the exchange rate of the GBP/USD currency pair. According to etymology, it roots to the 19th century when the large cable was used to transmit the exchange rates between USD and GBP across the Atlantic. A safety feature for the EMS which creates an emergency exit for currencies which become the singular focus of various adverse forces. Switching into another currency by buying spot and selling forward, and investing proceeds in order to obtain a higher interest yield. Interest arbitrage can be inward, i.e. from foreign currency into the local one or outward, i.e. from the local currency to the foreign one. Sometimes better results can be obtained by not selling the forward interest amount.